23-24 Feb, 2012

Shanghai, CHINA

InterContinental Shanghai Pudong

InterContinental Shanghai Pudong

"Rising Capacities in Asia &

"CEPSA started construction of a chemical plant in Shanghai, a key step in its strategy of globally expanding its operations. CEPSA's new plant, located in Shanghai Chemical Industry Park (SCIP), will have capacity to produce 250,000 tonne of phenol and 150,000 tonne of acetone. The facilities are slated to come on-stream at the end of 2013." [20 October 2011, World of Chemicals]

"As part of Bayer's strategy, a new polycarbonate production facility is scheduled to be built in Shanghai with a capacity of 200,000 metric t/y. In addition, at the same location it is planned to increase the capacity of Bayer's existing plant by 100,000 t/y, to 300,000 t/y. This is part of a EUR 1 billion investment plan till 2016 at the Bayer Integrated Site Shanghai, announced end-2010." [19 May 2011, pudaily.com]

Expansion plans and investments by the big players in the phenol and acetone industry are taking place rapidly these days. Companies, recognizing the growing demand from the China market, have made plans to increase production capacities by either expanding their current plants or build new ones in a bid to augment supply.

Undeniably, China is a huge market with immense growth expected. To fully capitalize this market and ensure swift decision making, Bayer MaterialScience has relocated their global headquarters from Germany to Shanghai. Hear from them as they talk about the China's fast-growing polycarbonate market and plans to increase their foothold in Asia Pacific. Momentive Performance Materials also acknowledges the robust demand in the downstream markets and subsequently went into a joint venture with UPC Technology to produce phenolic resins in China. They will be sharing details of this project.

Currently, this industry is experiencing widespread restructuring where the older and smaller scale units shut down, while others like Sunoco's sales of its phenol complex leaving it with no stand-alone chemical complexes. Cumene supply is expected to be short in the long term when some of the plants in US close down due to low profit margins. Find out from Sumitomo Corporation about the cumene market dynamics and its forecasted demand and supply.

As the automotive industry grows by leaps and bounds, how does it drive the demand for polymers like phenolic resins, MMA and polycarbonate and what are the consumption trends? How is the MMA market faring with the rise in production of LED/ LCD screens?

Attend CMT's 9th Phenol/Acetone & Derivatives Markets conference to find out more about these developments and the future growth of phenol & acetone markets. Register online at www.cmtevents.com with your team today! |

Key Reasons to be at

Be at this exciting event and make new contacts! CMT's 9th Phenol/Acetone & Derivatives Markets conference offers extensive business networking opportunities with Asian and global players in one venue! Sign up with your team to enjoy group discount. Register online at www.cmtevents.com or email to grace@cmtsp.com.sg.

You will network with: Presidents, MDs, SVPs, VPs, GMs/Managers from Commercial/Foreign Trade, Sales & Marketing, |

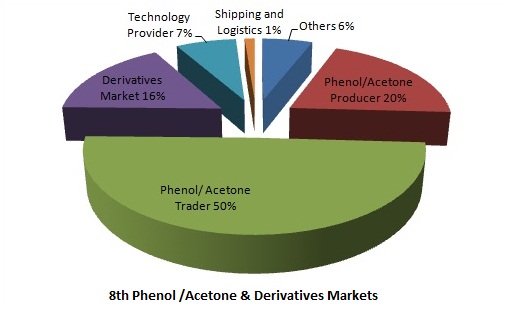

| PROFILE OF PAST YEAR ATTENDEES |

|---|

| Related articles for your reference and reading pleasure: |