|

"Moving down the value chain and opportunities in Africa's downstream markets"

"Improving Smallholders’ Competitiveness and

Balancing Growth with Sustainability"

|

Opening Speech

Cote D'Ivoire Agriculture Roadmap and Reformation of the Oil Palm Sector

His Excellency Mamadou Sangafowa Coulibaly

Minister of Agriculture & Rural Development

Cote D‘Ivoire

|

|

|

Palm oil production in West and Central Africa is growing rapidly, and it is estimated that up to 22 million hectares of land in could be converted to oil palm plantations over the next five years.

In Africa, where smallholders dominate the industry, the income earned from palm oil makes a critical contribution to their households .Women especially , handle most of the production, from the harvest and processing, to the sale of the oil and other oil palm products in the local markets. Palm oil, the vegetable oil of choice for much of Africa continues to thrive and large producers and mill operators have to increasingly engage with smallholders.

What is currently being done to improve the competitiveness of smallholders ?

Are capital and credit facility readily available to smallholders ?

How are big plantation companies engaging smallholders and how successful are the outgrower schemes ? Has crop prices declined in the last year and scaled down their development plans ? With concerns on deforestation, loss of biodiversity and human rights violations, are some oil palm companies dissuaded from pursuing further concession negotiations ?

How successful are current government strategies across African palm oil producing countries, in encouraging growth of the industry and creating a level playing field for all ?

Cote d’Ivoire earns 60% of her GDP from Agriculture and oil palm is the 3rd export agricultural commodity.

The country together with Ghana and Liberia have already developed national principles for the responsible production of palm oil for their countries and are finalising roadmaps to implement these principles on the ground.

What is the agriculture roadmap for the country and what importance is placed on palm oil for future ? |

CMT’s 4th AFRICA Palm Oil Value Chain Summit engages all stakeholders, including the public and the private sectors, downstream processors to come together in Abidjan Côte d’Ivoire to jointly identify the issues surrounding palm oil production in their countries.

Key highlights on what/who you will expect to hear from

- Dekel Oil – a large-scale palm oil production operation in Côte d’Ivoire with extensive agricultural and oil palm processing infrastructure.

- Socfin the challenge on balancing the potential for economic development with conservation and sustainability

- 2 leading downstream processors – Sania in Cote D’Ivoire and Avnash Group Ghana

- In Africa, palm oil is a key input for convenience food eg instant noodles, bread, chocolate spreads and other FMCGs, like soaps, detergents

- Singapore-based Olam is developing its palm assets in Africa with plantations in Gabon, Liberia and Cote d 'Ivoire. Investing in research & development is the key for Olam’s sustainable palm oil plantations in Africa

- Sharing of experience from a smallholder’s perspective – Plantation Porquet

- African Development Bank’s commitment to finance agriculture development in Cameroon

- Irrigation and water use efficiency – experience in Africa from agriculture expert Shyam Ponnapa with long standing experience in Africa

- Improving smallholders competitiveness and role of CIRAD

- Unlocking the potential of smallholders in Africa – from an investor’s perspective and experience in Ghana & Sierra Leone

- Public Private Partnerships for Oil Palm development - the Uganda Experience.

Don’t delay. Register 3 or more to gain group discounts. Contact hafizah@cmtsp.com.sg for more information. |

"Déplaçant en bas la chaîne de valeur et les opportunités chez les marchés en aval de l’Afrique"

"Améliorer la compétitivité des petits exploitants et équilibrer la croissance avec le développement durable"

|

Discours d’ouverture

Feuille de route de l’agriculture en Côte D'Ivoire et réforme

du secteur du palmier à huile

Son Excellence Mamadou Sangafowa Coulibaly

Ministre de l’Agriculture & du Développement Rural, Côte D‘Ivoire

|

|

|

La production d’huile de palme en Afrique D’ouest et Centrale est en croissance rapide, et selon les estimations, une superficie maximale de 22 millions d’hectares pourra être transformée pour des plantations d’huile de palme au cours des cinq prochaines années.

En Afrique, où les petits exploitants dominent l'industrie, les revenus gagnés de l'huile de palme apportent une contribution essentielle dans leurs ménages. Les femmes en particulier, gèrent la majeure partie de la production, dès la récolte et la transformation, jusqu’à la vente de l'huile et d'autres produits de palmiers dans les marchés locaux. L'huile de palme, l'huile végétale de choix d’une grande partie de l'Afrique, continue à prospérer et des grands producteurs et les opérateurs de moulin doivent de plus en plus s'engager avec les petits exploitants.

Qu'est-ce qui se fait actuellement pour améliorer la compétitivité des petits exploitants? Est-ce que l’accès aux capitaux et aux crédits sont-ils facilement accessibles pour eux? Comment est-ce que les grandes entreprises de plantation engagent des petits exploitants et dans quelle mesure les systèmes de plantation satellites sont-ils efficaces? Est-ce que les prix des produits agricoles ont-ils décliné pendant l’année dernière et réduit leurs plans de développement? Avec les préoccupations sur la déforestation, la perte de la biodiversité et les violations des droits humains, les entreprises de palmier à huile sont-elles dissuadées de poursuivre des négociations de concession?

Quel est le succès des stratégies gouvernementales actuelles pour des pays Africains producteurs d’huile de palme, pour encourager la promotion du développement de l’industrie et pour créer de conditions équitables pour tous?

60% du PIB de la Côte d’Ivoire provient de l’agriculture et l’huile de palme est le 3ème produit agricole exporté. Avec le Ghana et le Libéria, ce pays a déjà développé des principes nationaux pour la production responsable d’huile de palme et est en train de finaliser les feuilles de route pour concrétiser ces principes sur le terrain.

Quelle est la feuille de route agricole pour le pays et quelle importance est accordée à l’huile de palme pour l’avenir?

|

Le 4ème Chaîne de Valeur, Huile de palme en AFRIQUE, regroupe toutes les partie prenants, y compris les secteurs publics et privés, et les processeurs en aval, à Abidjan, en Côte d’Ivoire, pour identifier conjointement les questions relatives à la production d’huile de palme dans leurs pays.

Intervenants/Points saillants auxquels vous pouvez vous attendre

- Dekel Oil – une opération de production d’huile de palme à grande échelle en Côte d’Ivoire avec une infrastructure agricole de grande taille et de traitement du palmier à huile.

- Socfin, le défi pour équilibrer le potentiel du développement économique avec la conservation et le développement durable

- 2 Processeurs aval principaux – Sania en Côte D’Ivoire et Avnash Group au Ghana

- En Afrique, l’huile de palme est un élément clé pour produits alimentaires prêts-à-servir comme les nouilles instantanées, le pain, la pâte à tartiner au chocolat et d’autres produits de grande consommation (PGC), comme les savons et les détergents

- Olam, basée à Singapour, est en procès de développer ses actifs à palme en Afrique avec des plantations au Gabon, au Libéria et en Côte d'Ivoire. Investir dans la recherche - développement est la clé des plantations d’huile de palme durable d’Olam en Afrique

- Partage d’expérience dès une perspective de petits exploitants – Plantation Porquet

- L’engagement de la Banque Africaine de Développement pour financer le développement agricole au Cameroun

- L’irrigation et l’utilisation efficace de l’eau – expérience en Afrique de l’expert en agriculture Shyam Ponnapa qui a une expérience solide en Afrique

- L’amélioration de la compétitivité chez des petits exploitants et le rôle de CIRAD

- Ouvrant le potentiel des petits exploitants en Afrique – la perspective et l’expérience d’un investisseur au Ghana et en Sierra Leone.

- La collaboration entre les secteurs publics et privés pour le développement du palmier à huile – l’expérience en Uganda.

N’attendez plus. Faites-vous inscrire 3 ou plus pour avoir un prix réduit en groupe. Contactez hafizah@cmtsp.com |

|

VISA INFO FOR FOREIGNERS |

|

Passport holders from the following countries are exempted from Visa formalities in Côte d’Ivoire - Austria (official passport), Benin, Brazil (official passport), Burkina Faso, Cape-Verde, Central Republic of Congo (Brazzaville), Chad, Gabon(official passport), Gambia, Ghana, Guinea, Guinea Bissau, Iran (official passport), Israel(official passport), Liberia, Mali, Mauritania, Morocco Niger, Nigeria, Philippines, Senegal, Seychelles, Sierra, South Africa (official passport), Leone, Togo, Tunisia, Uganda (official passport).

All other countries must apply for Visa.

1) Biometric Visa - Get biometric visa at nearest Embassy before departure

Apply from https://www.snedai.com/en/ and follow the instructions for VISA

CMT strongly recommends pre-arrival application at country of departure.

2) E-Visa - Apply online and get visa atPort Bouet Airport

Apply from https://www.snedai.com/en/ and follow the instructions for E-VISA

- Get visa at airport with the required documents

3) Visa on Arrival - If you have problems applying for visa via any of the 2 options above,

please contact CMT for assistance

PS; there is no refund of Visa fee if your application is unsuccessful.

Note: It takes 3-5 working days of processing time. Tourist visa does not require Letter of Invitation. Business visa application would require a Letter of Invitation from local Company in Côte d’Ivoire or CMT. | |

| 3rd Africa Palm Oil (Rubber & Cocoa) | 13-15 Oct 2015, Accra |

| Testimonials |

|

"Very Informative"

Ghana Oil Palm Development Company (GOPDC)

"The conference was very educative and informative"

Wilbahi Investments

"Great event to discuss, listen to and better understand opportunities within plantations in Africa"

Olam

"Provided a great and clear focus on the palm oil sector specifically for Africa"

Golden Oil Holdings

"High quality presentations"

K+S Kali

"It was a fantastic experience"

Center Piece Industries Ltd |

"Provided an opportunity to interact with research and funding companies"

Rubber Research Institute of Nigeria

"It was a good learning experience and I came across a few opportunities which we would like to explore in future"

De United Food & Industries

"Great diversity of presentations to show the different components of the value chain"

Institute of Agricultural Research for the Development (IRAD)

"Very enlightening and informative"

African Export and Import Bank (AFREXIMBANK)

"Well organized and good networking opportunities"

AFGRI Equipment

|

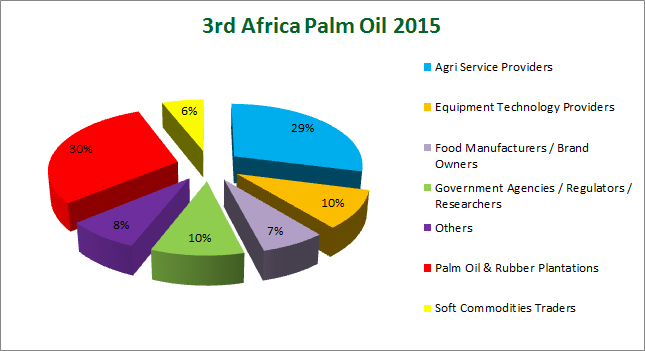

| Profile of attendees |

|

| |

| |